Thank You

Before you move forward with acquiring the DIYCreditOptimized.AI Credit Repair Tool for $49.95/month, here’s a step-by-step guide on how to proceed.

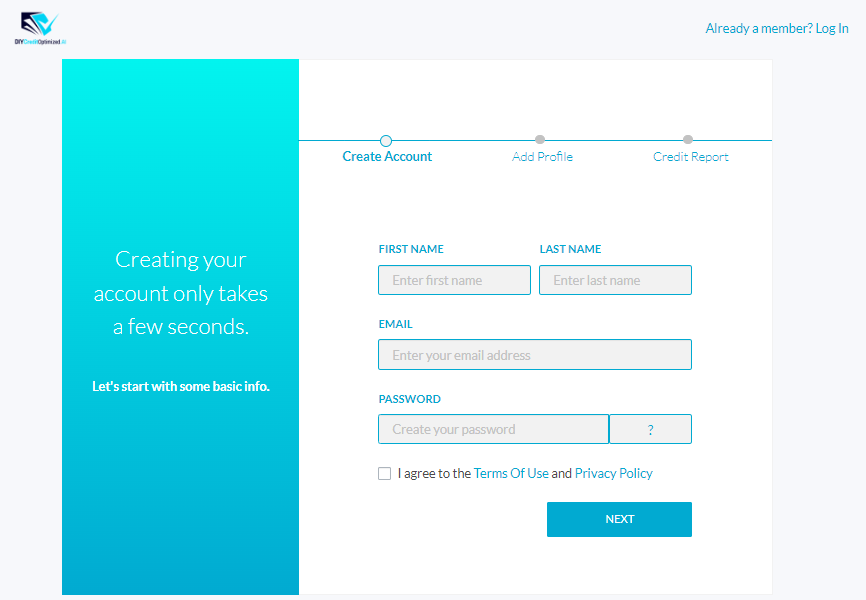

Step #1: Click the “Proceed” button after these instructions to navigate to the DIYCreditOptimized.AI Registration page.

Step #2: After clicking “Proceed”, you should see the registration page as shown in the screenshot below. Please ensure you complete the form with your details before pressing the “NEXT” button.

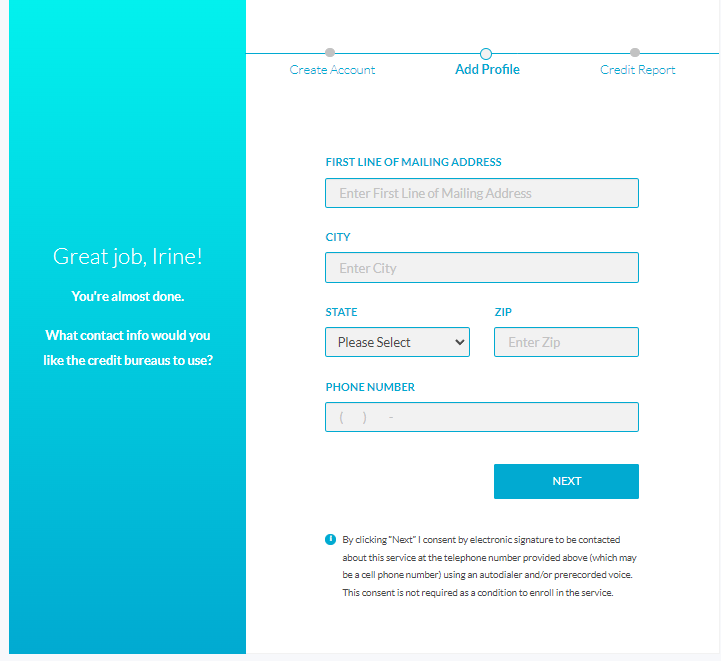

Step #3: Continue by filling out the form before hitting the “NEXT” button

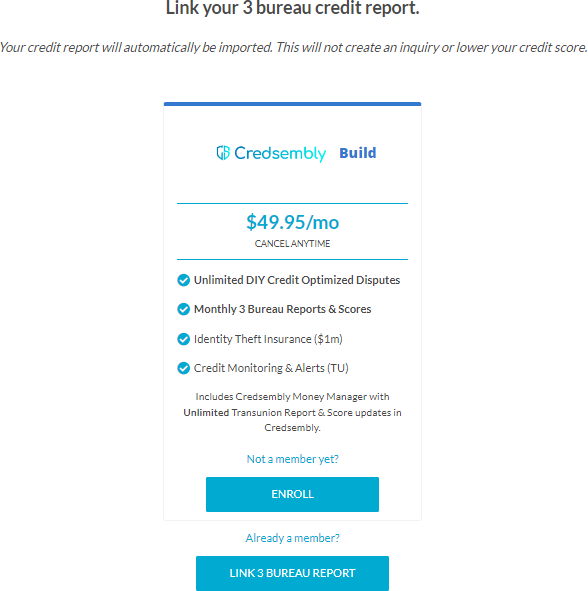

Step #4: If you are already a member of Credsembly Credit Monitoring, click LINK 3 BUREAU REPORT, otherwise, hit the ENROLL button and pay for the $49.95 per month. Please follow and complete the prompts, and you’ll be all set.

Step #5: Sign in to your DIYCreditOptimized.AI account at https://member.diycreditoptimized.ai using the email address you provided in Step #2, along with your password.

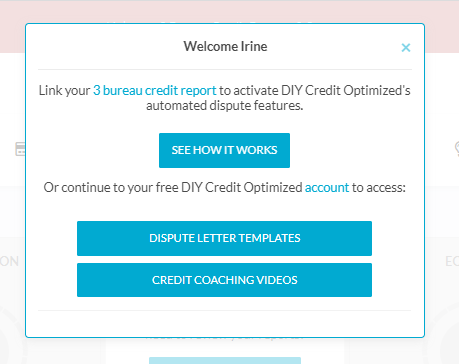

The first time you log in to your account, you will see this prompt below in your browser.

If you haven’t linked your 3B Report yet, please click the highlighted in blue “3 bureau credit report” link, or you may click the button “SEE HOW IT WORKS”

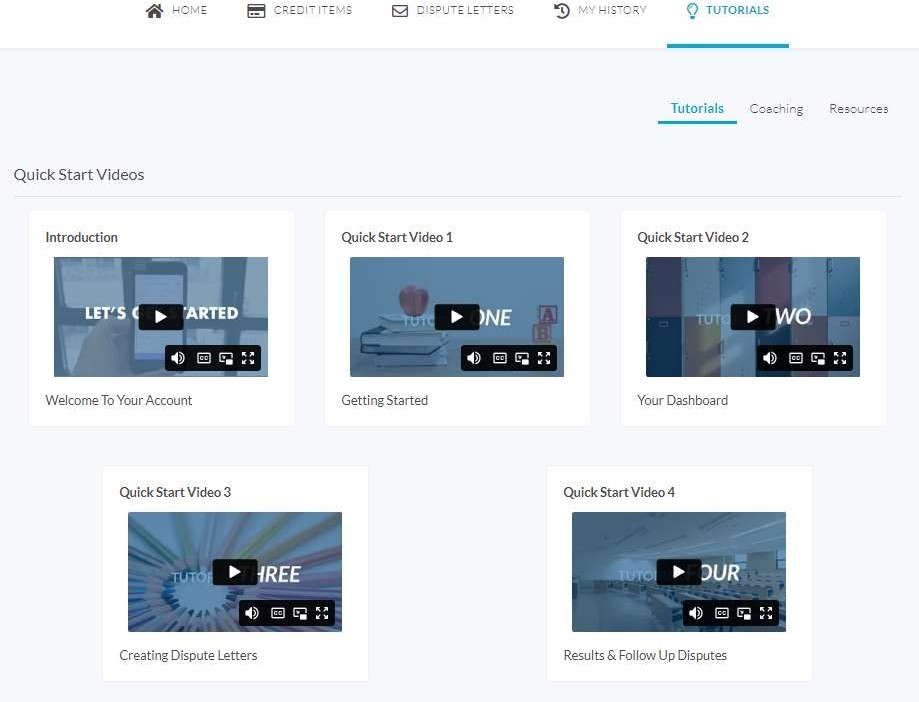

Step #6: Sign in to your DIYCreditUpon clicking the “SEE HOW IT WORKS” button, you are prompted to the Quick Start Videos.

It is recommended that you watch all the video tutorials in order to familiarize yourself with the step-by-step process of using DIYcreditOptimized.AI for your DIY credit repair process. This will help you to understand the process better and make the most of the tool’s features.

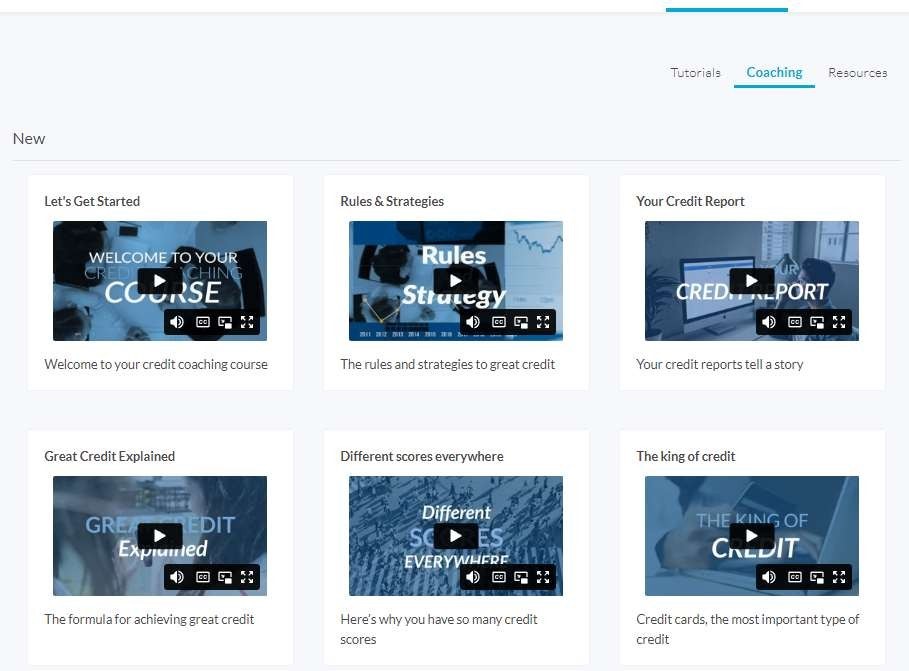

Step #7: Once you have finished watching the Quick Start Videos, navigate to the “Coaching” tab to access the Rules and Strategies that will guide you in winning the credit game.

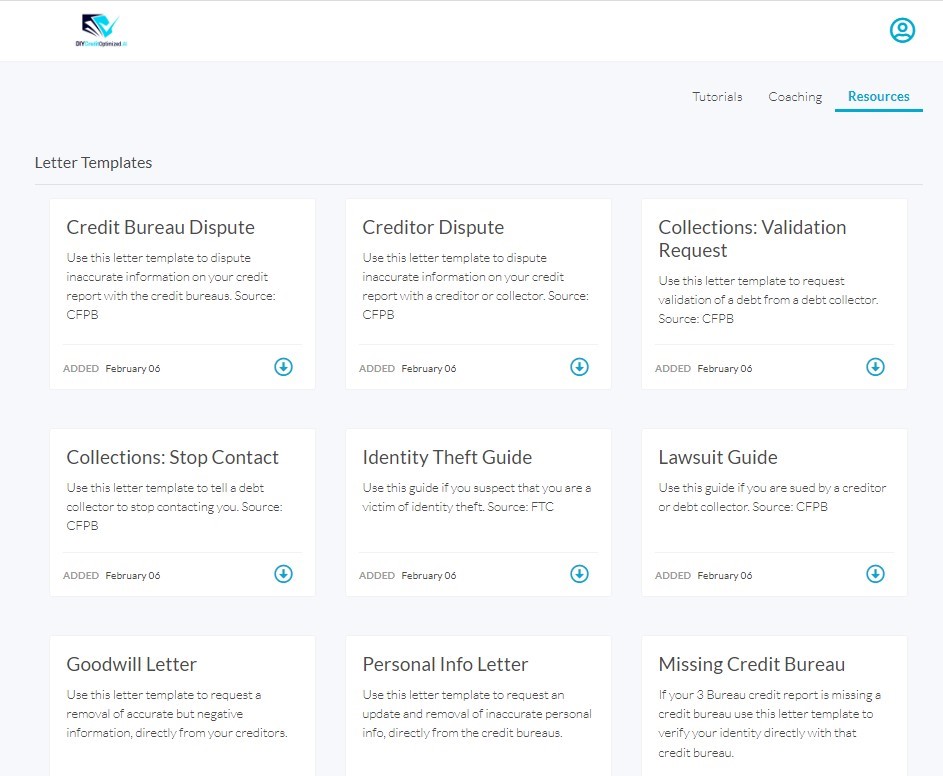

Step #8: After that, click on the “Resources” tab to access a variety of letter templates that will assist you in your credit repair journey for various situations.

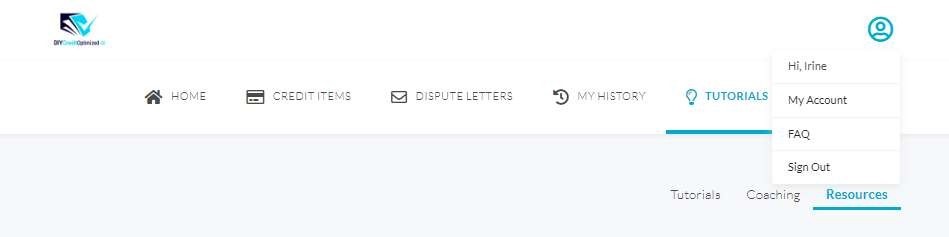

Step #9: To access the FAQ section, click on the person account located in the upper right-hand corner to reveal the dropdown menu, then select the FAQ tab.

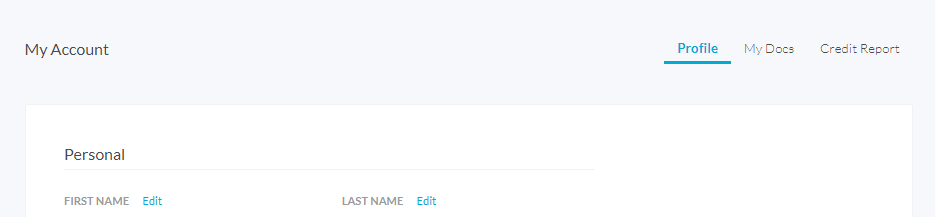

Step #10: If you need to update your profile information, change your password, or make changes to your documents and credit report, simply click on the “My Account” tab to access the page where you can make all the necessary updates to your account.

Step #11: Here’s what your “My Account” section looks like:

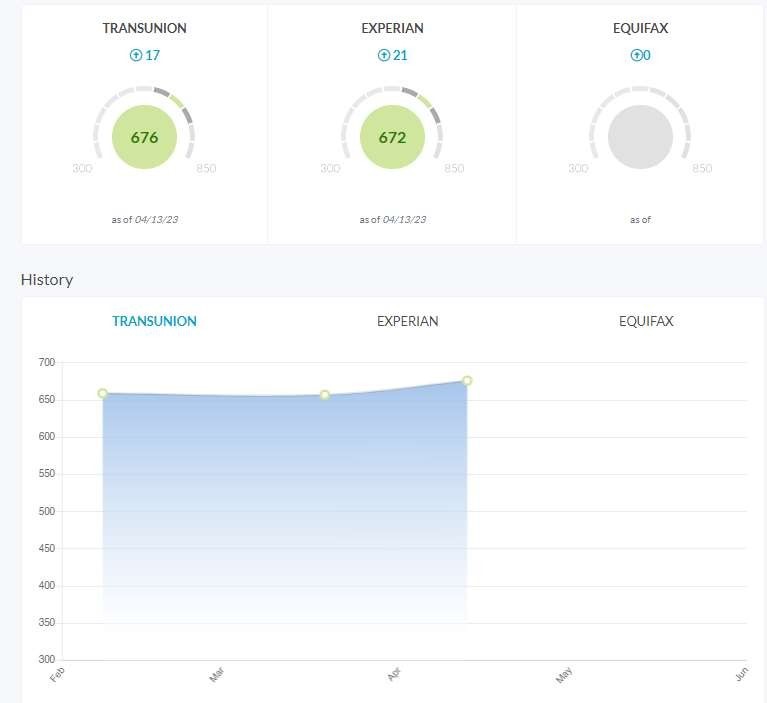

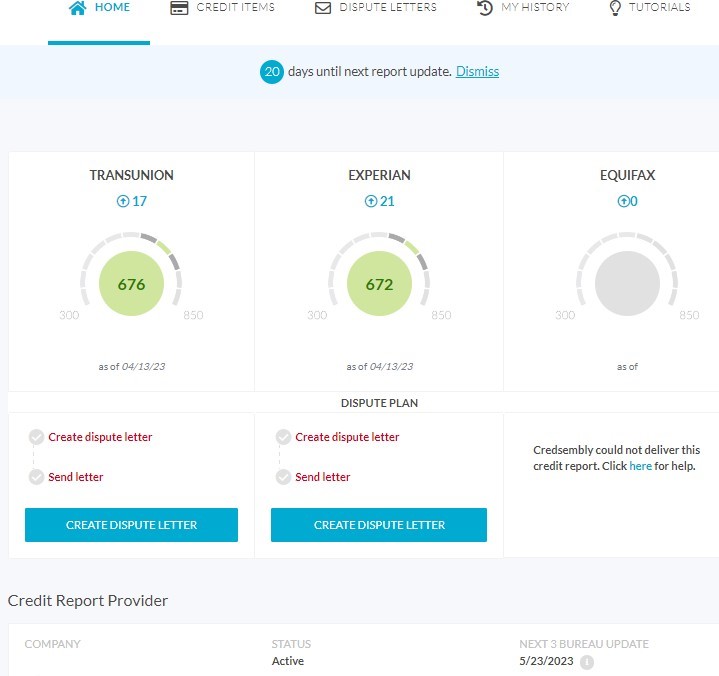

Step #12: On the “Home” tab, you can view an overview of your current credit disputes, your credit score, and the number of points your credit score has increased. This is also where you can create dispute letters.

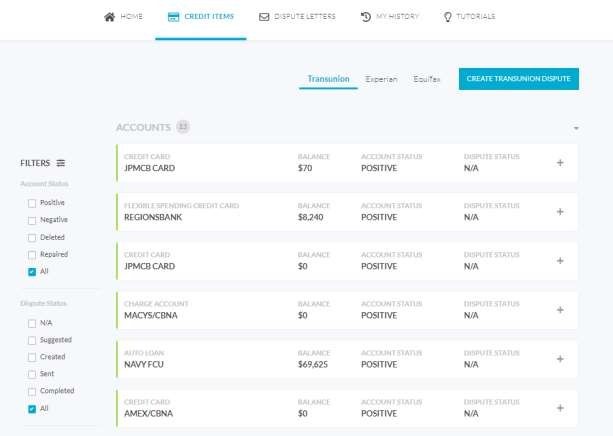

Step #13: On the “Credit Items” tab, you can view your credit items from TransUnion, Experian, and Equifax. Additionally, this is where you can create each of the 3B disputes.

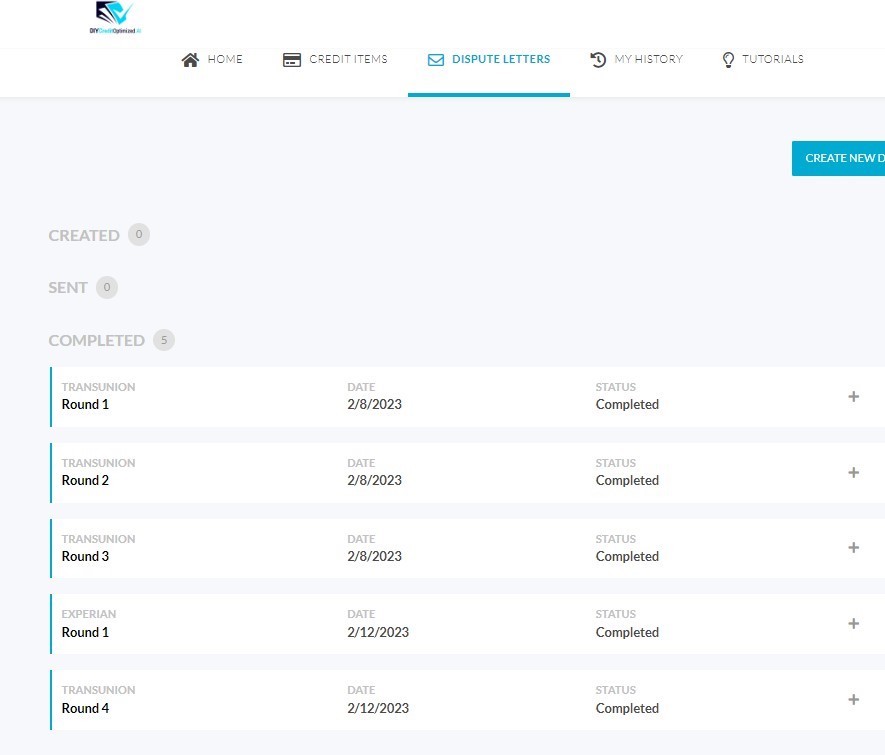

Step #14: The “Dispute Letters” tab allows you to track the number of completed rounds of letters for your credit dispute process. In addition, you can also create new disputes from this tab.

Step #15: Lastly, on the “My History” tab, you can view the history of your credit dispute actions and see how they have impacted your credit.